Trustage Auto & Home Insurance Program

Contents

- 1 An Overview of Trustage Auto & Home Insurance Program

- 2 Introduction

- 3 Strengths of Trustage Auto & Home Insurance Program

- 4 Weaknesses of Trustage Auto & Home Insurance Program

- 5 Trustage Auto & Home Insurance Program Information

- 6 Frequently Asked Questions about Trustage Auto & Home Insurance Program

- 6.1 1. How do I file a claim with Trustage Auto & Home Insurance Program?

- 6.2 2. Can I customize my Trustage Auto Insurance policy?

- 6.3 3. What factors affect my home insurance premium?

- 6.4 4. Are there discounts available for bundling auto and home insurance?

- 6.5 5. Can I manage my Trustage policies online?

- 6.6 6. How long does it take to receive a quote from Trustage?

- 6.7 7. What is Trustage’s cancellation policy?

- 6.8 8. Is Trustage Auto & Home Insurance Program suitable for first-time homeowners?

- 6.9 9. How often should I review my insurance coverage?

- 6.10 10. Can I obtain a quote without providing personal information?

- 6.11 11. Does Trustage offer any discounts for safe driving?

- 6.12 12. How do I contact Trustage’s customer support?

- 6.13 13. Can I transfer my existing insurance policy to Trustage?

- 7 Conclusion

- 8 Closing Words

An Overview of Trustage Auto & Home Insurance Program

Hello Readers, welcome to this article where we will delve into the world of Trustage Auto & Home Insurance Program. Insurance serves as a safety net, providing financial protection and peace of mind. Trustage is a well-known provider of auto and home insurance, offering comprehensive coverage and competitive rates. In this article, we will explore the strengths and weaknesses of Trustage Auto & Home Insurance Program, providing you with a detailed understanding of its offerings.

Introduction

Trustage Auto & Home Insurance Program is a trusted name in the insurance industry, renowned for its reliable and customer-centric approach. With a range of policies designed to meet individual needs, Trustage ensures that customers have access to the coverage they require.

Founded on the principles of trust and transparency, Trustage Auto & Home Insurance Program aims to deliver quality service and financial protection to its policyholders. By partnering with leading insurance providers, Trustage offers comprehensive policies that safeguard your assets and provide financial support during unexpected events.

Whether you are seeking auto insurance to protect your vehicle or looking for home insurance to safeguard your property, Trustage has you covered. Their team of experienced professionals is committed to providing personalized solutions that meet your unique insurance requirements.

Now, let’s dive into the strengths and weaknesses of Trustage Auto & Home Insurance Program to help you make an informed decision.

Strengths of Trustage Auto & Home Insurance Program

1. Comprehensive Coverage Options: Trustage Auto & Home Insurance Program offers a wide range of coverage options, allowing policyholders to tailor their insurance policies to their specific needs. From basic liability coverage to comprehensive plans, Trustage ensures that you are protected from various risks.

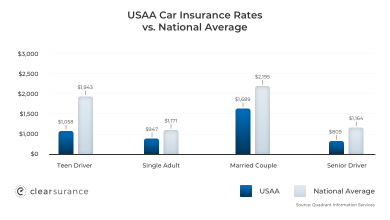

2. Competitive Rates: Trustage understands the importance of affordability when it comes to insurance. With their competitive rates, they strive to make insurance accessible to a broad range of individuals.

3. Trusted Insurance Providers: Trustage partners with top-rated insurance providers, ensuring that you receive coverage from reputable and reliable companies. This gives you peace of mind knowing that your policy is backed by industry leaders.

4. Dedicated Customer Support: Trustage is committed to providing exceptional customer service. Their knowledgeable and friendly team is available to assist you with any queries or concerns you may have throughout the insurance process.

5. Convenient Online Platform: Trustage provides an intuitive online platform, making it easy for customers to manage their policies, make payments, and access important documents. This ensures a seamless and hassle-free insurance experience.

6. Additional Benefits and Discounts: Trustage offers various additional benefits and discounts to policyholders, such as safe driver discounts, multi-policy discounts, and accident forgiveness programs. These incentives help to reduce insurance costs while rewarding responsible and loyal customers.

7. Financial Stability: Trustage’s partnership with highly-rated insurance providers ensures their financial stability. This instills confidence in policyholders, knowing that their claims will be handled efficiently and that their coverage is secure.

Weaknesses of Trustage Auto & Home Insurance Program

1. Limited Availability: Trustage Auto & Home Insurance Program may not be available in all areas, limiting access to their policies for certain individuals.

2. Lack of Customization: While Trustage offers a range of coverage options, some individuals may find the level of customization limited, as certain specialized coverage may not be available.

3. Limited Online Reviews: Trustage Auto & Home Insurance Program has limited online reviews, making it difficult for prospective customers to gauge the experiences of others before making a decision.

4. Exclusion of Certain Risks: Like any insurance policy, Trustage Auto & Home Insurance Program may have exclusions and limitations, which may not provide coverage for specific risks or events.

5. Limited Policy Management Options: While Trustage’s online platform is convenient, it may be lacking certain features for policyholders who prefer more extensive policy management options.

6. Limited Local Presence: Trustage Auto & Home Insurance Program’s limited local presence may result in less personalized service for some policyholders who prefer face-to-face interactions.

7. Potential Rate Fluctuations: Trustage’s competitive rates may be subject to fluctuations due to various factors, potentially affecting policyholders’ premiums over time.

Trustage Auto & Home Insurance Program Information

| Insurance Type | Coverage Details | Policy Options |

|---|---|---|

| Auto Insurance | – Liability coverage – Comprehensive coverage – Collision coverage – Personal injury protection – Uninsured and underinsured motorist coverage |

– Basic coverage – Enhanced coverage – Personalized coverage options |

| Home Insurance | – Dwelling coverage – Personal property coverage – Liability coverage – Additional living expenses coverage – Medical payments coverage |

– Standard coverage – Enhanced coverage – Additional coverage options |

Frequently Asked Questions about Trustage Auto & Home Insurance Program

1. How do I file a claim with Trustage Auto & Home Insurance Program?

Answer: To file a claim, you can contact Trustage’s dedicated claims department through their website or by phone. They will guide you through the process and ensure that your claim is handled promptly.

2. Can I customize my Trustage Auto Insurance policy?

Answer: Yes, Trustage Auto Insurance offers various policy options and coverage add-ons, allowing you to customize your policy based on your specific needs.

Answer: Factors such as the location of your home, its age, construction materials, and previous claims history can all impact your home insurance premium.

4. Are there discounts available for bundling auto and home insurance?

Answer: Yes, Trustage offers discounts for bundling auto and home insurance policies, helping you save money while ensuring comprehensive coverage.

5. Can I manage my Trustage policies online?

Answer: Yes, Trustage provides an online platform where you can manage your policies, make payments, and access important documents conveniently.

6. How long does it take to receive a quote from Trustage?

Answer: Trustage aims to provide quotes within a short period, typically within a few minutes. However, the exact timeframe may vary depending on various factors.

7. What is Trustage’s cancellation policy?

Answer: Trustage’s cancellation policy varies depending on the specific circumstances. It is best to contact their customer support for detailed information regarding policy cancellations.

8. Is Trustage Auto & Home Insurance Program suitable for first-time homeowners?

Answer: Yes, Trustage Auto & Home Insurance Program caters to the needs of a wide range of individuals, including first-time homeowners. Their policies provide essential coverage and peace of mind during this significant life event.

9. How often should I review my insurance coverage?

Answer: It is recommended to review your insurance coverage annually or whenever significant changes occur in your life, such as purchasing a new vehicle or renovating your home.

10. Can I obtain a quote without providing personal information?

Answer: Trustage’s quoting process may require certain personal information to accurately assess your insurance needs and provide an accurate quote.

11. Does Trustage offer any discounts for safe driving?

Answer: Yes, Trustage offers safe driver discounts to policyholders with a clean driving record. By practicing safe driving habits, you can enjoy additional savings on your premiums.

12. How do I contact Trustage’s customer support?

Answer: You can reach Trustage’s customer support team through their website, where they provide various contact options, including phone, email, and online chat.

13. Can I transfer my existing insurance policy to Trustage?

Answer: Trustage provides a seamless transition process for policyholders looking to transfer their existing policies. It is advisable to contact their customer support for detailed instructions and guidance.

Conclusion

In conclusion, Trustage Auto & Home Insurance Program offers comprehensive coverage, competitive rates, and exceptional customer service. While it may have limitations, such as limited availability and customization options, Trustage remains a reliable choice for individuals seeking trustworthy auto and home insurance. By leveraging their trusted insurance provider partnerships and user-friendly online platform, Trustage delivers the peace of mind and financial protection you need. Take action today and explore Trustage’s offerings to ensure the safety and security of your assets.

Remember, insurance is an investment in your future, providing a safety net during uncertain times. Protect what matters most to you with Trustage Auto & Home Insurance Program.

Closing Words

In conclusion, it is crucial to carefully consider your insurance options and choose a provider that aligns with your needs. Trustage Auto & Home Insurance Program is a reputable choice, offering comprehensive coverage, competitive rates, and dedicated customer support. However, as with any insurance decision, we recommend reviewing the terms and conditions of your policy before making a final decision. Insurance needs can vary greatly, so it’s essential to select a policy that meets your individual requirements.

Remember to consult with insurance professionals, compare quotes, and assess your coverage needs regularly. By staying informed and proactive, you can ensure that you have the right insurance program in place to protect your assets and provide peace of mind. Trustage Auto & Home Insurance Program stands ready to assist you on this journey, offering trusted insurance solutions to safeguard your auto and home.

Insurance coverage is a crucial aspect of a comprehensive financial plan. By choosing Trustage Auto & Home Insurance Program, you are taking a significant step towards securing your future. Take action today and explore the coverage options provided by Trustage, ensuring that you and your assets are protected from life’s unexpected events. Peace of mind awaits – choose Trustage Auto & Home Insurance Program.