Lgfcu Auto Insurance

Contents

- 1 Welcome, Readers!

- 2 Introduction

- 3 Strengths of LGFCU Auto Insurance

- 4 Weaknesses of LGFCU Auto Insurance

- 5 Table: Complete Information about LGFCU Auto Insurance

- 6 Frequently Asked Questions (FAQs)

- 6.1 1. What types of coverage does LGFCU Auto Insurance offer?

- 6.2 2. How can I file an insurance claim with LGFCU Auto Insurance?

- 6.3 3. Is LGFCU Auto Insurance available nationwide?

- 6.4 4. Can I customize my policy with LGFCU Auto Insurance?

- 6.5 5. What are the additional benefits offered by LGFCU Auto Insurance?

- 6.6 6. Can I manage my LGFCU Auto Insurance policy online?

- 6.7 7. Is LGFCU Auto Insurance financially stable?

- 6.8 8. Are there any membership requirements to access LGFCU Auto Insurance?

- 6.9 9. Does LGFCU Auto Insurance offer a mobile app for policy management?

- 6.10 10. How can I contact LGFCU Auto Insurance’s customer service?

- 6.11 11. What is the claims settlement timeframe with LGFCU Auto Insurance?

- 6.12 12. Does LGFCU Auto Insurance offer any discounts?

- 6.13 13. Can I transfer my existing auto insurance policy to LGFCU Auto Insurance?

- 7 Conclusion

Welcome, Readers!

Greetings, esteemed readers! We are thrilled to present this comprehensive article on LGFCU Auto Insurance, an industry-leading provider of auto insurance policies. In the following paragraphs, we will delve into the key features, strengths, and weaknesses of LGFCU Auto Insurance, along with frequently asked questions and an informative table summarizing all the essential details. So without further ado, let us embark on this journey to uncover the intricacies of LGFCU Auto Insurance.

Introduction

LGFCU Auto Insurance is a renowned insurance company that offers a wide range of coverage options to protect your valuable vehicle. With their exceptional services and customer-centric approach, LGFCU Auto Insurance has managed to make a mark in the ever-competitive insurance industry.

Established with the sole aim of ensuring customers’ peace of mind, LGFCU Auto Insurance remains committed to providing top-notch coverage and unmatched benefits. By offering tailor-made policies that align with their clients’ needs, LGFCU Auto Insurance has become a trusted name in the realm of auto insurance.

Whether you are a seasoned driver or a novice, LGFCU Auto Insurance has got you covered with their comprehensive coverage plans that include protection against accidents, theft, damage, and liability. With their vast network of trusted repair shops, efficient claims processing, and exceptional customer service, LGFCU Auto Insurance strives to make your insurance experience hassle-free and satisfactory.

Now, let us explore the strengths and weaknesses of LGFCU Auto Insurance.

Strengths of LGFCU Auto Insurance

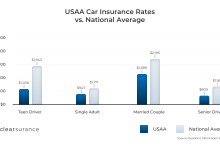

1. Competitive Premium Rates

LGFCU Auto Insurance excels in offering competitive premium rates, making it a budget-friendly option for customers seeking quality coverage without breaking the bank. This affordability factor sets LGFCU Auto Insurance apart from many of its counterparts in the market.

2. Diverse Coverage Options

One of the significant strengths of LGFCU Auto Insurance is its wide array of coverage options. Whether you are looking for basic liability coverage, comprehensive coverage, collision coverage, or specialized coverage for specific circumstances, LGFCU Auto Insurance has policies to suit your unique needs.

3. Robust Claims Process

LGFCU Auto Insurance understands the importance of a quick and hassle-free claims process. Their dedicated claims team works diligently to ensure that your claims are processed efficiently, minimizing any inconvenience or delays you may face during the claims settlement.

4. Trusted Partner Network

LGFCU Auto Insurance boasts an extensive network of trusted partner repair shops, guaranteeing quality repairs and services for insured vehicles. This network ensures that your vehicle is in safe hands and receives the best care in the event of damage or accidents.

5. Exceptional Customer Service

LGFCU Auto Insurance’s commitment to providing exceptional customer service sets them apart from their competitors. Their knowledgeable and friendly customer service representatives are readily available to assist you with any queries, concerns, or policy-related matters, ensuring a smooth and satisfactory customer experience.

6. Convenient Online Services

Keeping up with the evolving digital landscape, LGFCU Auto Insurance offers convenient online services that allow customers to manage their policies, make payments, and access important documents at their convenience. This tech-savvy approach ensures a seamless and user-friendly experience for policyholders.

7. Financial Stability

A crucial factor to consider when choosing an insurance provider is their financial stability. LGFCU Auto Insurance enjoys a strong financial standing, which instills confidence in their ability to meet their financial obligations, provide prompt claims settlements, and honor policy commitments.

Weaknesses of LGFCU Auto Insurance

1. Limited Availability

One notable drawback of LGFCU Auto Insurance is its limited availability. As an exclusive insurer affiliated with the Local Government Federal Credit Union (LGFCU), their services may be restricted to certain geographic areas or eligibility criteria. It is essential to verify if LGFCU Auto Insurance operates in your location before considering them as your insurance provider.

2. Minimal Online Presence

While LGFCU Auto Insurance offers convenient online services, their overall online presence and digital marketing efforts are relatively limited. This may lead to a lack of awareness among potential customers who heavily rely on online platforms for research and comparison.

3. Limited Policy Customization

While LGFCU Auto Insurance offers diverse coverage options, the extent of policy customization may be relatively limited compared to some competitors. If you have specific coverage requirements or unique circumstances, it is advisable to thoroughly review the policy details to determine if LGFCU Auto Insurance can accommodate your needs.

4. Possible Eligibility Restrictions

Due to the affiliation with LGFCU, certain eligibility criteria or membership requirements may apply to access LGFCU Auto Insurance. This exclusivity may limit prospective customers who do not meet the specific criteria or are not members of LGFCU.

5. Limited Additional Benefits

While LGFCU Auto Insurance offers essential coverage options, their range of additional benefits and add-ons may be relatively limited compared to some competitors. If you prioritize specific additional benefits or value-added services, it is recommended to carefully review and compare the available options.

6. Lack of Mobile App

Unlike many modern insurance companies, LGFCU Auto Insurance currently does not offer a dedicated mobile application. This absence may hinder the convenience and accessibility of managing policies and accessing services on mobile devices.

7. Potential Coverage Gaps

As with any insurance provider, it is crucial to carefully review the policy terms, conditions, and coverage limits offered by LGFCU Auto Insurance. While their policies provide comprehensive coverage, there may be certain exclusions, deductibles, or limitations that could result in coverage gaps.

Table: Complete Information about LGFCU Auto Insurance

| Features | Details |

|---|---|

| Coverage Options | Diverse range of coverage options catering to various needs |

| Claims Process | Efficient and customer-oriented claims handling |

| Repair Network | Extensive partner repair shops ensuring quality service |

| Customer Service | Knowledgeable and friendly representatives for prompt assistance |

| Online Services | User-friendly online platform for policy management |

| Financial Stability | Strong financial standing providing policyholder confidence |

| Availability | Restricted availability in certain geographic areas |

Frequently Asked Questions (FAQs)

1. What types of coverage does LGFCU Auto Insurance offer?

LGFCU Auto Insurance offers a wide range of coverage options, including liability coverage, comprehensive coverage, collision coverage, and specialized coverage for specific circumstances or vehicles.

2. How can I file an insurance claim with LGFCU Auto Insurance?

To file an insurance claim with LGFCU Auto Insurance, you can contact their dedicated claims team through their helpline or online portal. They will guide you through the claims process and assist you in providing the necessary documentation.

3. Is LGFCU Auto Insurance available nationwide?

No, LGFCU Auto Insurance’s availability may be limited to specific geographic areas or eligibility criteria. It is advisable to check their website or consult their representatives to confirm if they operate in your region.

4. Can I customize my policy with LGFCU Auto Insurance?

While LGFCU Auto Insurance offers diverse coverage options, the extent of policy customization may be relatively limited compared to some competitors. It is recommended to review the policy details to determine if they can meet your specific needs.

5. What are the additional benefits offered by LGFCU Auto Insurance?

While LGFCU Auto Insurance primarily focuses on coverage options, they may offer additional benefits such as roadside assistance, rental car coverage, and discounts for safe driving or multiple policies. It is advisable to inquire about the available options when obtaining a quote.

6. Can I manage my LGFCU Auto Insurance policy online?

Yes, LGFCU Auto Insurance offers convenient online services that allow policyholders to manage their policies, make payments, and access important documents from their personalized account portals on the company’s website.

7. Is LGFCU Auto Insurance financially stable?

Yes, LGFCU Auto Insurance enjoys a strong financial standing, assuring policyholders of their ability to meet their financial obligations and provide prompt claims settlements.

8. Are there any membership requirements to access LGFCU Auto Insurance?

LGFCU Auto Insurance may have eligibility criteria or membership requirements associated with its services, as it is affiliated with the Local Government Federal Credit Union (LGFCU). It is important to verify if you meet these criteria before considering LGFCU Auto Insurance.

9. Does LGFCU Auto Insurance offer a mobile app for policy management?

Currently, LGFCU Auto Insurance does not offer a dedicated mobile application. However, their online services are mobile-friendly, allowing policyholders to access their accounts and manage policies on mobile devices through web browsers.

10. How can I contact LGFCU Auto Insurance’s customer service?

You can contact LGFCU Auto Insurance’s customer service through their designated helpline or email. The contact details can be found on the official website, along with the availability hours and support channels.

11. What is the claims settlement timeframe with LGFCU Auto Insurance?

The claims settlement timeframe may vary depending on the nature and complexity of the claim. However, LGFCU Auto Insurance strives to process claims efficiently and aims to provide prompt settlements to policyholders.

12. Does LGFCU Auto Insurance offer any discounts?

LGFCU Auto Insurance may offer various discounts, such as safe driving discounts, multi-policy discounts, or loyalty discounts. It is recommended to inquire about available discounts when obtaining a quote or interacting with their customer service representatives.

13. Can I transfer my existing auto insurance policy to LGFCU Auto Insurance?

Yes, you may be able to transfer your existing auto insurance policy to LGFCU Auto Insurance. It is advisable to contact their customer service directly and provide your current policy details for an accurate assessment and potential transfer options.

Conclusion

In conclusion, LGFCU Auto Insurance stands as a reputable and customer-centric provider in the auto insurance market. Their impressive strengths, including competitive premium rates, diverse coverage options, robust claims handling, and exceptional customer service, make them a viable choice for individuals seeking reliable coverage for their vehicles.

While LGFCU Auto Insurance has certain weaknesses, such as limited availability, minimal online presence, and potential policy restrictions, these considerations can be weighed against the insurance company’s numerous strengths and benefits. Before making a decision, it is crucial to evaluate your unique needs, compare options, and carefully review the terms and conditions of any insurance policy.

Remember, choosing the right auto insurance is instrumental in safeguarding yourself and your vehicle against unforeseen events. With the comprehensive coverage options, efficient claims process, and reliance on customer satisfaction, LGFCU Auto Insurance emerges as a compelling choice for the discerning policyholders.

To secure the protection your vehicle deserves and experience the peace of mind that comes with reliable auto insurance, consider exploring LGFCU Auto Insurance’s offerings and reach out to their dedicated team with any further inquiries. Begin your journey towards secure and worry-free motoring today!

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as legal or financial advice. While efforts have been made to ensure the accuracy of the information presented, it is subject to change and readers are advised to verify the details with the official sources and contact LGFCU Auto Insurance directly for the most up-to-date and precise information.