Introduction

Hello Readers,

Welcome to this informative article about Trustage Auto Insurance Rating. In today’s fast-paced world, it is crucial to have reliable and trustworthy auto insurance coverage. Trustage Auto Insurance Rating aims to provide comprehensive coverage that meets the needs and expectations of its customers. In this article, we will delve into the strengths and weaknesses of Trustage Auto Insurance Rating, along with a detailed explanation of what sets it apart from its competitors.

Strengths and Weaknesses

Strengths

1. Extensive Coverage Options: Trustage Auto Insurance Rating offers a wide range of coverage options to cater to the diverse needs of policyholders. Whether you are looking for basic liability coverage or comprehensive coverage that includes collision and comprehensive protection, Trustage has got you covered.

2. Competitive Premiums: Trustage Auto Insurance Rating strives to offer competitive premiums that provide value for money. Their insurance rates are affordable, enabling policyholders to protect their vehicles without breaking the bank.

3. Stellar Customer Service: Trustage prides itself on its exceptional customer service. Their dedicated team is always ready to assist policyholders, whether it’s for claims processing, policy changes, or general inquiries. Their prompt and professional service ensures a hassle-free experience for customers.

4. Convenient Online Access: Trustage Auto Insurance Rating provides policyholders with an online portal where they can easily access their policy details, make payments, and submit claims. This accessibility enhances convenience and simplifies insurance management.

5. Financial Stability: Trustage Auto Insurance Rating has a solid financial foundation, ensuring that they can meet their financial obligations to policyholders in the event of claims. Their stability provides peace of mind for customers, knowing that their claims will be fully supported.

6. Flexible Payment Options: Trustage understands that different policyholders have varied financial circumstances. They offer flexible payment options, including monthly installments, annual payments, and automatic deductions, to accommodate different budgets.

7. Strong Reputation: Trustage Auto Insurance Rating is backed by the TruStage Insurance Agency, which is renowned for its reliability and trustworthiness in the insurance industry. Their reputation adds credibility to the policies offered by Trustage.

Weaknesses

1. Limited Availability: Trustage Auto Insurance Rating is not available in all states, which can be a constraint for potential customers residing in areas where coverage is not offered.

2. Limited Add-Ons: While Trustage offers comprehensive coverage options, their selection of add-ons or endorsements is relatively limited compared to some competitors. This may restrict policyholders who want to customize their coverage further.

3. Lack of 24/7 Customer Support: Although Trustage provides excellent customer service, their support may not be available 24/7, which could inconvenience policyholders requiring immediate assistance outside regular business hours.

4. Less Extensive Discounts: While Trustage offers competitive premiums, they have fewer discounts compared to some other auto insurers. This may limit potential savings for policyholders who qualify for various discount programs.

5. Limited Digital Experience: As digital insurance experiences become increasingly important, Trustage’s online portal and mobile app may not offer the same level of functionality and user experience as some competitors.

6. Exclusion of High-Risk Drivers: Trustage has certain criteria for accepting policyholders, and they may exclude high-risk drivers or individuals with a history of driving violations. This can limit access to coverage for some potential customers.

7. Limited Claim Transparency: Trustage may not provide detailed transparency into the claims process, which can be a concern for policyholders who want more visibility and insight into the progress of their claims.

Trustage Auto Insurance Rating Information

| Policy Coverage |

Details |

| Liability Coverage |

Provides financial protection in case you cause an accident where others are injured or property is damaged. |

| Collision Coverage |

Covers damage to your vehicle if involved in a collision, regardless of fault. |

| Comprehensive Coverage |

Protects against damage to your vehicle from theft, vandalism, natural disasters, and other non-collision incidents. |

Frequently Asked Questions

1. Is Trustage Auto Insurance Rating available nationwide?

Answer: Unfortunately, Trustage Auto Insurance Rating is not available in all states. Make sure to check their availability in your state before considering their coverage.

2. Can I add additional drivers to my Trustage policy?

Answer: Yes, Trustage allows you to add additional drivers to your policy. However, their driving records and other factors may impact the premium.

Conclusion

In conclusion, Trustage Auto Insurance Rating offers a range of strengths, including extensive coverage options, competitive premiums, stellar customer service, and convenient online access. However, it also has some weaknesses, such as limited availability and add-ons, as well as a lack of 24/7 customer support. Despite these limitations, Trustage’s strong reputation, financial stability, and flexible payment options make it a viable choice for many auto insurance seekers. It is important to thoroughly evaluate your specific needs and compare multiple insurance providers before making a decision. We encourage you to take action by researching further and potentially reaching out to Trustage for a personalized quote.

Disclaimer: The information provided in this article is for informational purposes only. It is advisable to review the terms and conditions of Trustage Auto Insurance Rating and consult with a qualified insurance professional before making any insurance-related decisions.

Checkout These Recommendations:

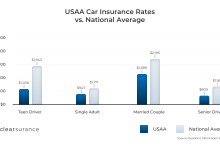

- Auto Insurance Usaa Quote Introduction Hello readers, Welcome to our informative article on Auto Insurance USAA Quote. In today's fast-paced world, it is vital to have reliable auto insurance coverage to protect yourself and…

- Usa Auto Insurance Quote Greeting Readers, Welcome to Our Comprehensive Guide on Usa Auto Insurance Quote When it comes to protecting your vehicle, having the right auto insurance coverage is crucial. With the wide…

- Cornell Auto Insurance Hello, Readers! Welcome to our comprehensive guide on Cornell Auto Insurance. In this article, we will delve into the strengths, weaknesses, and key aspects of this reputable auto insurance provider.…

- Attorney Auto Insurance Claim Greeting Readers! Welcome to this comprehensive guide on Attorney Auto Insurance Claim. In this article, we will discuss the ins and outs of handling an auto insurance claim with the…

- Trustage Auto Insurance Personal Invitation Number A Trusted Insurance Option with Personalized Benefits Hello Readers, welcome to our article on Trustage Auto Insurance Personal Invitation Number. In this comprehensive guide, we will discuss everything you need…

- Get Usaa Auto Insurance Quote Welcome, Readers! Greetings to all the readers who are seeking comprehensive and reliable auto insurance coverage. In this article, we will delve into the world of USAA auto insurance and…

- Nh Auto Insurance Requirements Welcome, Readers! Thank you for joining us today as we delve into the auto insurance requirements in the state of New Hampshire. Whether you're a new driver or a seasoned…

- Auto Insurance Attorney California Welcome, Readers! Greetings, readers! We hope this article finds you in good health and high spirits. Today, we delve into the world of auto insurance attorneys in California. If you've…

- Aaa Nj Auto Insurance Introduction Hello, Readers! Welcome to our comprehensive guide on Aaa Nj Auto Insurance. In today's fast-paced world, owning a car comes with various risks. From unforeseen accidents to theft, having…

- Auto Insurance Claim Attorney Near Me Introduction Hello Readers, Welcome to our comprehensive guide on finding the perfect auto insurance claim attorney near you. Dealing with auto insurance claims can be a daunting task, especially when…

- Trustage Auto And Home Insurance Reviews The Trusted Choice for Auto and Home Insurance Needs Hello readers! Welcome to our comprehensive review of Trustage Auto and Home Insurance. As the leading provider of insurance solutions, Trustage…

- Best Home And Auto Insurance In Oregon Introductory Words Hello Readers! When it comes to protecting your home and automobile in the beautiful state of Oregon, it's essential to find the best insurance coverage at the most…

- Auto Insurance Hendersonville Greetings, Readers! Welcome to an informative journal article designed to provide you with valuable insights into auto insurance in Hendersonville. Whether you are an experienced driver or just getting behind…

- Usaa Quote For Auto Insurance Introduction Hello, Readers! Welcome to this comprehensive article on USAA Quote for Auto Insurance. If you are in search of reliable and affordable auto insurance, then USAA could be the…

- Lawyer For Insurance Claims Auto Near Me Introduction Hello, Readers! Welcome to our article on finding a reliable lawyer for insurance claims related to auto accidents. Dealing with insurance claims for auto accidents can be a complex…

- Lgfcu Auto Insurance Welcome, Readers! Greetings, esteemed readers! We are thrilled to present this comprehensive article on LGFCU Auto Insurance, an industry-leading provider of auto insurance policies. In the following paragraphs, we will…

- Auto Insurance Claim Lawyers Near Me Welcome Readers! Greetings, dear readers! We hope this article finds you in good health and high spirits. Today, we delve into the world of auto insurance claim lawyers near you…

- Pros And Cons Of Trustage Auto Insurance Introduction Hello Readers, Welcome to this in-depth analysis of the pros and cons of Trustage Auto Insurance. Trustage Auto Insurance is a leading provider of auto insurance policies, offering coverage…

- Aaa Auto Insurance Tulsa Introduction Hello Readers! Are you looking for comprehensive and affordable auto insurance in Tulsa? Look no further than Aaa Auto Insurance Tulsa. With its extensive coverage options, competitive rates, and…

- Trustage Auto And Home Insurance Program An Overview of Trustage Auto And Home Insurance Program Hello Readers, Welcome to our article on Trustage Auto And Home Insurance Program. In this piece, we will provide you with…

- Aaa Auto Insurance Retrieve Quote The Key to Hassle-Free Auto Insurance Quotes Hello, Readers! Today, we are here to guide you through the process of retrieving a quote from Aaa Auto Insurance – a renowned…

- Apply For Usaa Auto Insurance Welcome Readers Hello readers, welcome to our comprehensive guide on how to apply for USAA auto insurance. If you are in search of reliable and trustworthy auto insurance coverage, USAA…

- Trustage Auto Insurance Quote Welcome, Readers! Greetings to all car owners and insurance seekers! In this article, we will delve into the world of Trustage Auto Insurance Quote, a renowned provider of reliable and…

- Aaa South Jersey Auto Insurance The Best Auto Insurance Option in South Jersey Hello Readers, Welcome to our comprehensive guide on Aaa South Jersey Auto Insurance. In this article, we will explore the features, strengths,…

- Aaa Auto Insurance Tulsa Oklahoma Introduction Hello, Readers! Welcome to our comprehensive guide on Aaa Auto Insurance in Tulsa, Oklahoma. In this article, we will delve into the various aspects of Aaa Auto Insurance, including…

- Trustage Auto & Home Insurance Program An Overview of Trustage Auto & Home Insurance Program Hello Readers, welcome to this article where we will delve into the world of Trustage Auto & Home Insurance Program. Insurance…

- Norfolk & Dedham Auto Insurance Greetings, Readers! Welcome to our in-depth coverage of Norfolk & Dedham Auto Insurance, a prominent name in the insurance industry. In this article, we will delve into the strengths and…

- Is Trustage Auto Insurance Good Introduction Hello readers, welcome to this article discussing Trustage Auto Insurance. In today's world, finding the right car insurance can be overwhelming. With numerous options available, it's crucial to evaluate…

- Usaa Auto Insurance Military Discount Introduction Hello Readers, welcome to this comprehensive article that will provide you with all the essential information about the USAA Auto Insurance Military Discount. If you are a military personnel…

- Auto Insurance Lawyer California Welcome, Readers! Greetings, dear readers! We warmly welcome you to this enlightening article dedicated to one of the most vital aspects of safeguarding your auto insurance rights in California -…