Cornell Auto Insurance

Contents

- 1 Hello, Readers!

- 2 Introduction

- 3 Cornell Auto Insurance – At a Glance

- 4 Frequently Asked Questions (FAQs)

- 4.1 1. What factors influence my auto insurance premium?

- 4.2 2. Does Cornell Auto Insurance offer discounts for safe drivers?

- 4.3 3. Can I customize my auto insurance policy?

- 4.4 4. How can I file a claim with Cornell Auto Insurance?

- 4.5 5. Is roadside assistance included in Cornell Auto Insurance policies?

- 4.6 6. Can I add multiple vehicles to my Cornell Auto Insurance policy?

- 4.7 7. Are their policies available for motorcycles and RVs?

- 4.8 8. What payment options are available for Cornell Auto Insurance policies?

- 4.9 9. Does Cornell Auto Insurance provide discounts for bundling policies?

- 4.10 10. Can I switch to Cornell Auto Insurance if I have an existing policy with another provider?

- 4.11 11. Does Cornell Auto Insurance offer 24/7 customer support?

- 4.12 12. Can I obtain a quote for Cornell Auto Insurance online?

- 4.13 13. How long does it take to receive my insurance card from Cornell Auto Insurance?

- 5 Conclusion

Hello, Readers!

Welcome to our comprehensive guide on Cornell Auto Insurance. In this article, we will delve into the strengths, weaknesses, and key aspects of this reputable auto insurance provider. Whether you are a new car owner or looking to switch insurance companies, we aim to provide you with valuable insights to make an informed decision.

Introduction

When it comes to protecting your valuable asset, Cornell Auto Insurance offers a range of policies tailored to meet your needs. With their vast experience in the industry, they have established a strong reputation for providing reliable coverage and exceptional customer service. Let’s explore the ins and outs of Cornell Auto Insurance and discover why it might be the perfect choice for you.

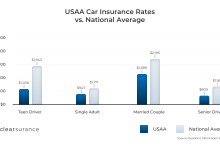

1. Competitive Rates:

One of the primary strengths of Cornell Auto Insurance is their commitment to providing competitive rates for their policyholders. They understand the importance of affordability without compromising on the quality of coverage. By offering competitive prices, they ensure that customers can protect their vehicles without breaking the bank.

2. Wide Coverage Options:

Cornell Auto Insurance offers a diverse range of coverage options to cater to different needs. From basic liability coverage to comprehensive plans that protect against various risks, they have it all. Whether you are a new driver or an experienced one, you can find a policy that suits your requirements.

3. Excellent Customer Service:

One of the notable strengths of Cornell Auto Insurance is their commitment to providing excellent customer service. Their team of knowledgeable professionals is always ready to assist policyholders with any inquiries or concerns. Their dedication to customer satisfaction sets them apart from other insurance providers.

4. Easy Claims Process:

In the unfortunate event of an accident or vehicle damage, Cornell Auto Insurance understands the urgency of claims processing. They have streamlined their claims process, ensuring a hassle-free experience for their policyholders. With their prompt and efficient service, you can have peace of mind knowing that your claims will be handled swiftly.

5. Financial Stability:

Cornell Auto Insurance boasts a strong financial standing, which is crucial in the insurance industry. This stability ensures that they can fulfill their obligations to policyholders, especially during critical times. Policyholders can rest assured that Cornell Auto Insurance has the financial strength to support them when needed.

6. Limited Regional Availability:

One aspect that can be considered a weakness of Cornell Auto Insurance is their limited regional availability. Currently, they only offer their services in select states. If you reside outside their coverage area, you will need to explore other insurance providers.

7. Limited Online Presence:

While Cornell Auto Insurance has made strides in improving their online platforms, there is still room for growth. Their online presence and accessibility could be further enhanced, providing policyholders with more convenience and accessibility when managing their accounts or seeking assistance.

Cornell Auto Insurance – At a Glance

| Features | Details |

|---|---|

| Insurance Types | Auto, Motorcycle, RV |

| Coverage Options | Liability, Collision, Comprehensive |

| Roadside Assistance | Available |

| Claims Process | Efficient and streamlined |

| Special Discounts | Safe driver, multi-vehicle, and more |

Frequently Asked Questions (FAQs)

Your auto insurance premium can be influenced by various factors, including your driving history, age, location, type of vehicle, and desired coverage level.

2. Does Cornell Auto Insurance offer discounts for safe drivers?

Yes, Cornell Auto Insurance offers special discounts for safe drivers who have a clean driving record and demonstrate responsible driving habits.

3. Can I customize my auto insurance policy?

Absolutely! Cornell Auto Insurance provides options for policyholders to customize their coverage based on their individual needs and preferences.

4. How can I file a claim with Cornell Auto Insurance?

You can file a claim with Cornell Auto Insurance by reaching out to their claims department directly through their website or by contacting their dedicated claims hotline.

5. Is roadside assistance included in Cornell Auto Insurance policies?

Yes, Cornell Auto Insurance offers roadside assistance as an additional coverage option to provide policyholders with peace of mind on the road.

6. Can I add multiple vehicles to my Cornell Auto Insurance policy?

Absolutely! Cornell Auto Insurance offers flexible policies that allow you to add multiple vehicles and extend coverage to your entire fleet.

7. Are their policies available for motorcycles and RVs?

Yes, Cornell Auto Insurance provides insurance coverage for motorcycles and RVs, ensuring that your additional vehicles are also protected.

8. What payment options are available for Cornell Auto Insurance policies?

Cornell Auto Insurance offers various payment options, including online payments, automatic deductions, and traditional mailing of payment.

9. Does Cornell Auto Insurance provide discounts for bundling policies?

Yes, Cornell Auto Insurance offers discounts for policyholders who choose to bundle multiple insurance policies, such as home and auto insurance.

10. Can I switch to Cornell Auto Insurance if I have an existing policy with another provider?

Absolutely! Cornell Auto Insurance welcomes policyholders from other insurance providers. You can switch to their coverage at any time, subject to their terms and conditions.

11. Does Cornell Auto Insurance offer 24/7 customer support?

Yes, Cornell Auto Insurance provides round-the-clock customer support to address any concerns or queries you may have, ensuring exceptional service whenever you need it.

12. Can I obtain a quote for Cornell Auto Insurance online?

Absolutely! Cornell Auto Insurance offers an easy-to-use online quoting tool that allows you to obtain a personalized quote within minutes.

13. How long does it take to receive my insurance card from Cornell Auto Insurance?

Typically, you can expect to receive your insurance card from Cornell Auto Insurance within a few business days after successfully purchasing your policy.

Conclusion

After exploring the strengths, weaknesses, and key aspects of Cornell Auto Insurance, it is clear that they are a reputable provider offering competitive rates, wide coverage options, and excellent customer service. With their streamlined claims process, financial stability, and additional benefits like roadside assistance, Cornell Auto Insurance proves to be a reliable choice for protecting your vehicle.

Don’t wait any longer – take action today and reach out to Cornell Auto Insurance to get a quote or switch to their coverage. Don’t compromise on the safety and protection of your valuable asset. Make the right choice with Cornell Auto Insurance.

Note: The information provided in this article is for general informational purposes only and should not be considered legal or financial advice. Always consult with a qualified professional regarding your specific circumstances.