Auto Insurance Hendersonville

Contents

- 1 Greetings, Readers!

- 2 Introduction

- 3 Strengths and Weaknesses of Auto Insurance Hendersonville

- 4 Frequently Asked Questions (FAQs) about Auto Insurance Hendersonville

- 4.1 1. What is liability coverage, and is it required?

- 4.2 2. Can I transfer my out-of-state auto insurance to Hendersonville?

- 4.3 3. What factors can affect my auto insurance premiums in Hendersonville?

- 4.4 4. Are there any discounts available?

- 4.5 5. What should I do if I am involved in a car accident in Hendersonville?

- 4.6 6. Can I cancel my auto insurance policy at any time?

- 4.7 7. Do I need additional coverage if I have a brand new car?

- 5 Conclusion

Greetings, Readers!

Welcome to an informative journal article designed to provide you with valuable insights into auto insurance in Hendersonville. Whether you are an experienced driver or just getting behind the wheel, it is essential to understand the importance of having reliable coverage for your vehicle. In this article, we will delve into the world of auto insurance in Hendersonville, exploring its strengths, weaknesses, frequently asked questions, and more.

Introduction

Auto insurance in Hendersonville is not just a legal requirement, but a safeguard that ensures your financial protection in case of any unforeseen accidents or damages. By choosing the right policy from reputable insurance providers, you can drive with confidence, knowing that you are protected against any potential liabilities.

1. Coverage Options: Understanding the availability and suitability of coverage options is crucial when selecting an auto insurance policy in Hendersonville. From liability coverage to comprehensive and collision coverage, it is essential to evaluate your needs and choose a policy that suits your unique requirements.

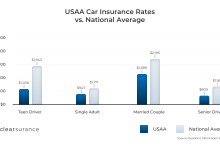

2. Cost Considerations: While auto insurance is a necessity, it is still important to find affordable premiums that fit within your budget. Factors such as your age, driving record, and the type of vehicle you own can influence the cost of your insurance. Comparing quotes from different providers can help you find competitive rates.

3. Customer Service: When it comes to auto insurance, having a reliable and efficient customer service team is of utmost importance. Look for insurance providers in Hendersonville that offer excellent customer service, as they can assist you promptly in case of any emergencies, queries, or claims.

4. Financial Stability: Opting for an insurance company with a strong financial background is crucial. This ensures that the company has the resources to meet its financial obligations, especially during times of increased claims volume.

5. Local Expertise: Choosing an auto insurance provider with a strong local presence can bring added advantages. Insurers with a deep understanding of the Hendersonville area can provide you with tailored coverage and advice specific to the region’s unique driving conditions.

6. Flexibility in Policies: Life is full of surprises, and your insurance policy should be flexible enough to adapt to changing circumstances. Look for providers that offer customizable policies, allowing you to modify coverage limits, deductibles, and add additional coverage options according to your evolving needs.

7. Claims Process: In the unfortunate event of an accident, having a smooth claims process can go a long way in reducing stress and ensuring a speedy resolution. Investigate the claims process of different insurance providers in Hendersonville to find one that is efficient and hassle-free.

Strengths and Weaknesses of Auto Insurance Hendersonville

Auto insurance in Hendersonville, like any other service, has its own set of strengths and weaknesses. Understanding these can help you make an informed decision:

Strengths:

1. Comprehensive Coverage Options: Auto insurance in Hendersonville offers a wide range of coverage options to protect your vehicle and yourself against potential risks. From liability coverage to comprehensive and collision coverage, you can tailor your policy to suit your specific needs.

2. Financial Protection: By investing in auto insurance, you ensure financial protection against costly repairs, medical expenses, and even legal liabilities resulting from accidents.

3. Peace of Mind: Driving without proper auto insurance can lead to anxiety and stress. By having coverage, you can enjoy peace of mind knowing that you are protected in case of any unfortunate incidents on the road.

4. Legal Compliance: Driving without insurance is illegal in Hendersonville, and having the appropriate coverage ensures that you abide by the law while taking responsibility for your actions.

Weaknesses:

1. Cost: Auto insurance premiums can be a financial burden, especially for individuals with limited budgets. However, by comparing quotes and exploring available discounts, you can find affordable options that meet your needs.

2. Deductibles: Auto insurance policies typically require policyholders to pay a deductible before coverage kicks in. This out-of-pocket expense can be a disadvantage if you face multiple claims over a short period, but it helps keep premiums manageable.

3. Policy Limitations: Some policies may have limitations or exclusions that could restrict coverage in certain situations. It is essential to carefully review the terms and conditions before purchasing a policy to ensure it aligns with your specific requirements.

| Category | Information |

|---|---|

| Auto Insurance Coverage | Hendersonville offers a variety of coverage options, including liability, comprehensive, collision, uninsured/underinsured motorist, personal injury protection (PIP), and more. |

| Policy Costs | Insurance premiums depend on factors such as driver age, driving record, vehicle type, coverage limits, deductibles, and discounts applied. |

| Insurance Providers | Hendersonville boasts numerous reputable insurance providers, offering various policies tailored to individual needs. |

| Customer Service | Select an insurance provider that offers excellent customer service to assist you with queries, claims, and emergencies. |

| Claims Process | Understanding the claims process of different insurance providers can help you choose one that is efficient and hassle-free. |

Frequently Asked Questions (FAQs) about Auto Insurance Hendersonville

1. What is liability coverage, and is it required?

Liability coverage provides financial protection if you are at fault in an accident that causes injury or property damage. It is legally required in Hendersonville and most other states.

2. Can I transfer my out-of-state auto insurance to Hendersonville?

Upon moving to Hendersonville, you will typically need to obtain new auto insurance that complies with the state’s specific requirements. Speak to your insurance provider for guidance.

Several factors influence your auto insurance premiums, including your driving record, age, gender, type of vehicle, coverage limits, deductibles, and even your credit score. Providers consider these factors to assess risk and determine premiums.

4. Are there any discounts available?

Yes, many insurance providers in Hendersonville offer various discounts, such as good driver discounts, multi-policy discounts, student discounts, and more. Inquire about eligibility and potential savings when obtaining quotes.

5. What should I do if I am involved in a car accident in Hendersonville?

If you are involved in an accident, ensure your safety and that of others involved. Exchange contact and insurance information with other drivers, document the scene, and notify your insurance provider to initiate the claims process.

6. Can I cancel my auto insurance policy at any time?

Most auto insurance policies have cancellation provisions that allow you to terminate your policy. However, cancelling before the policy expiration may result in penalties or fees. Review your policy documents or contact your insurer for specific details.

7. Do I need additional coverage if I have a brand new car?

If you have a brand new car, you may consider additional coverage such as gap insurance or new car replacement coverage. These options can provide added financial protection in case your new vehicle is totaled or stolen.

Conclusion

In conclusion, auto insurance is a vital aspect of responsible vehicle ownership in Hendersonville. It provides financial protection, complies with legal requirements, and offers peace of mind. From coverage options to cost considerations, customer service to claims processes, it is crucial to carefully evaluate your needs and choose a reputable insurance provider in Hendersonville.

With comprehensive research, comparing quotes, and understanding the strengths and weaknesses of auto insurance, you can make an informed decision that safeguards your vehicle and provides you with the necessary protection on the road. Remember to regularly review and update your policy to ensure it still meets your evolving needs.

Thank you for reading this informative article on Auto Insurance Hendersonville. Drive safely and confidently with the right auto insurance coverage!

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered legal or financial advice. For specific insurance-related queries and coverage guidance, it is recommended to consult with a qualified insurance professional.