Pros And Cons Of Trustage Auto Insurance

Contents

- 1 Introduction

- 2 Introduction

- 3 Trustage Auto Insurance: Pros and Cons Overview

- 4 Frequently Asked Questions (FAQs)

- 4.1 1. Is Trustage Auto Insurance available to everyone?

- 4.2 2. Can I customize my Trustage Auto Insurance policy?

- 4.3 3. How can I file a claim with Trustage Auto Insurance?

- 4.4 4. Does Trustage Auto Insurance offer roadside assistance?

- 4.5 5. Can I save on my Trustage Auto Insurance premiums?

- 4.6 6. What happens if I switch credit unions or lose my membership?

- 4.7 7. Does Trustage Auto Insurance provide international coverage?

- 5 Conclusion

- 6 Closing Words

Introduction

Hello Readers,

Welcome to this in-depth analysis of the pros and cons of Trustage Auto Insurance. Trustage Auto Insurance is a leading provider of auto insurance policies, offering coverage for drivers of all ages and experience levels. In this article, we will explore the various strengths and weaknesses of Trustage Auto Insurance, providing you with valuable insights to help you make an informed decision when choosing an auto insurance provider.

Without further ado, let’s dive into the details and examine the pros and cons of Trustage Auto Insurance.

Introduction

To truly understand Trustage Auto Insurance and what it offers, we must first explore its strengths and weaknesses. By evaluating these aspects, potential policyholders can determine if Trustage Auto Insurance is the right fit for their specific needs.

Strengths of Trustage Auto Insurance

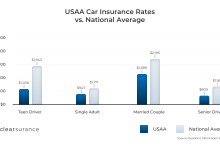

1. Competitive Pricing

One of the notable strengths of Trustage Auto Insurance is its competitive pricing. By offering affordable premiums, Trustage makes auto insurance accessible to a wide range of drivers. This is particularly beneficial for young drivers or those with a limited budget.

2. Extensive Coverage Options

Trustage Auto Insurance provides a comprehensive range of coverage options, ensuring that policyholders can tailor their policy to meet their individual needs. From basic liability coverage to comprehensive plans that include collision and comprehensive coverage, Trustage offers a variety of choices.

3. Strong Financial Stability

Having a financially stable insurance provider is essential to ensure that claims are processed efficiently and without hassle. Trustage Auto Insurance boasts a strong financial stability rating, providing policyholders with peace of mind that their claims will be handled promptly and adequately.

4. Excellent Customer Service

Trustage Auto Insurance prides itself on its exceptional customer service. The company offers 24/7 support, with knowledgeable and friendly representatives ready to assist policyholders with any questions or concerns they may have. This ensures a smooth and personalized experience throughout the policy term.

5. Wide Range of Discounts

Trustage Auto Insurance offers an array of discounts for policyholders, allowing them to save on their premiums. These discounts may include safe driver discounts, multi-policy discounts, or discounts for driving a vehicle equipped with advanced safety features. Taking advantage of these discounts can lead to substantial cost savings.

6. Quick and Easy Claims Process

Trustage Auto Insurance understands that the claims process can be stressful for policyholders. To alleviate this burden, Trustage has streamlined its claims process, making it quick and straightforward. Policyholders can file claims online or through the mobile app, ensuring convenience and efficiency.

7. Additional Policy Benefits

In addition to the standard coverage options, Trustage Auto Insurance offers various additional policy benefits. These may include rental car reimbursement, roadside assistance, and coverage for expenses related to accident forgiveness. These additional benefits enhance the overall value of Trustage Auto Insurance policies.

Weaknesses of Trustage Auto Insurance

1. Limited Availability

One of the main drawbacks of Trustage Auto Insurance is its limited availability. Trustage policies are only available to certain groups, such as credit union members, their families, and employees. This restricts the accessibility of Trustage auto insurance for a broader customer base.

2. Less Customization Options

While Trustage Auto Insurance offers a range of coverage options, some policyholders may find the level of customization to be limited. Compared to other providers, Trustage may have fewer add-ons or specialized coverage options available. This may not be suitable for individuals seeking highly tailored policies.

3. Lack of Local Agents

Trustage Auto Insurance primarily operates online and over the phone, which means there is a lack of local agents available for in-person assistance. Some individuals prefer the convenience and personalized experience of interacting with a local agent, which is not an option with Trustage.

4. Complex Discount Structure

While Trustage Auto Insurance offers a wide range of discounts, some policyholders may find their discount structure complex or confusing. Understanding eligibility requirements and calculating potential savings may require additional effort and research.

5. Limited Digital Tools

Trustage Auto Insurance’s digital tools and features may be less extensive compared to other auto insurance providers. Policyholders who prefer robust online account management systems or digital tools for claims tracking may find Trustage’s offerings to be limited.

6. Potential Price Variations

Due to Trustage Auto Insurance’s association with credit unions, pricing may vary based on the credit union a policyholder is affiliated with. This means that individuals who switch credit unions or lose their membership may face changes in their premiums or policy terms.

7. Lack of International Coverage

Trustage Auto Insurance focuses primarily on providing coverage within the United States. If you require international coverage or frequently travel abroad, Trustage may not be the most suitable choice for your auto insurance needs.

Trustage Auto Insurance: Pros and Cons Overview

| Pros | Cons |

|---|---|

| Competitive Pricing | Limited Availability |

| Extensive Coverage Options | Less Customization Options |

| Strong Financial Stability | Lack of Local Agents |

| Excellent Customer Service | Complex Discount Structure |

| Wide Range of Discounts | Limited Digital Tools |

| Quick and Easy Claims Process | Potential Price Variations |

| Additional Policy Benefits | Lack of International Coverage |

Frequently Asked Questions (FAQs)

1. Is Trustage Auto Insurance available to everyone?

No, Trustage Auto Insurance is only available to credit union members, their families, and employees.

2. Can I customize my Trustage Auto Insurance policy?

While Trustage offers a range of coverage options, customization options may be limited compared to other providers.

3. How can I file a claim with Trustage Auto Insurance?

You can file a claim with Trustage Auto Insurance online or through their mobile app for a quick and easy claims process.

4. Does Trustage Auto Insurance offer roadside assistance?

Yes, Trustage Auto Insurance provides roadside assistance as an additional policy benefit.

Absolutely! Trustage offers various discounts, such as safe driver discounts and multi-policy discounts, to help you save on premiums.

6. What happens if I switch credit unions or lose my membership?

Changes in your credit union affiliation may result in variations in your Trustage auto insurance premiums or policy terms.

7. Does Trustage Auto Insurance provide international coverage?

No, Trustage Auto Insurance primarily focuses on providing coverage within the United States.

Conclusion

In conclusion, Trustage Auto Insurance has several strengths that make it an attractive option for policyholders. Its competitive pricing, extensive coverage options, strong financial stability, and excellent customer service are noteworthy advantages. However, there are also some limitations to consider, such as limited availability, less customization options, and a complex discount structure.

Before making a decision, carefully analyze your specific needs and preferences. Review the strengths and weaknesses identified in this article, and compare them with other auto insurance providers available in your area. By conducting thorough research and due diligence, you can select an auto insurance provider that aligns with your requirements.

Remember, auto insurance is a vital investment in protecting yourself and your vehicle. Selecting the right provider can offer peace of mind and financial security in case of accidents or unforeseen circumstances.

Thank you for reading this comprehensive analysis of the pros and cons of Trustage Auto Insurance. We hope this article has provided you with valuable insights to assist you in making an informed decision. Stay safe on the roads!

Closing Words

Auto insurance is a critical aspect of responsible vehicle ownership. It provides financial protection in case of accidents or damages. While Trustage Auto Insurance has its strengths and weaknesses, it is essential to explore multiple options and compare quotes from different providers.

Remember to read the policy terms and conditions carefully and assess how well they align with your requirements. If in doubt, seek guidance from insurance professionals or trusted advisors who can provide personalized advice.

Ultimately, the choice of auto insurance provider should prioritize the coverage, affordability, and customer service that best suit your individual needs. Don’t hesitate to explore different policies and ask questions to ensure you make an informed decision.

Take action now and prioritize your auto insurance coverage – it’s the responsible choice for any vehicle owner. Drive safely, and may your journeys always be protected!