Aaa Auto Insurance Tulsa

Contents

- 1 Introduction

- 2 Strengths and Weaknesses of Aaa Auto Insurance Tulsa

- 3 Aaa Auto Insurance Tulsa: Coverage Options and Benefits

- 4 Frequently Asked Questions about Aaa Auto Insurance Tulsa

- 4.1 1. Can I get a quote online?

- 4.2 2. How can I file a claim?

- 4.3 3. Is roadside assistance included in all policies?

- 4.4 4. Are there discounts available for safe drivers?

- 4.5 5. Does Aaa Auto Insurance Tulsa offer coverage for classic cars?

- 4.6 6. Can I manage my policy online?

- 4.7 7. How can I contact Aaa Auto Insurance Tulsa?

- 5 Conclusion

- 6 Closing Words and Disclaimer

Introduction

Hello Readers! Are you looking for comprehensive and affordable auto insurance in Tulsa? Look no further than Aaa Auto Insurance Tulsa. With its extensive coverage options, competitive rates, and exceptional customer service, Aaa Auto Insurance Tulsa stands out as a top choice for car owners in the region. In this article, we will delve into the strengths and weaknesses of Aaa Auto Insurance Tulsa, provide detailed explanations of its coverage options, and answer frequently asked questions about the company. By the end of this article, you’ll have all the information you need to make an informed decision about insuring your vehicle with Aaa Auto Insurance Tulsa.

Strengths and Weaknesses of Aaa Auto Insurance Tulsa

Strengths

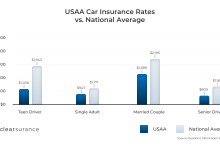

1. Competitive Rates: Aaa Auto Insurance Tulsa offers some of the most competitive rates in the market, ensuring that you get the best value for your money.

2. Extensive Coverage Options: The company provides a wide range of coverage options, from basic liability insurance to comprehensive coverage that protects you against various risks.

3. Excellent Customer Service: Aaa Auto Insurance Tulsa prides itself on delivering excellent customer service. Their knowledgeable representatives are always ready to assist you and help address any concerns or questions you may have.

4. Quick Claims Processing: In the unfortunate event of an accident, Aaa Auto Insurance Tulsa ensures a smooth and swift claims process. They understand the importance of getting you back on the road as soon as possible.

5. Additional Benefits: Aaa Auto Insurance Tulsa offers additional benefits such as roadside assistance and rental car reimbursement, providing you with peace of mind and convenience.

6. Customizable Policies: With Aaa Auto Insurance Tulsa, you have the flexibility to customize your policy to suit your specific needs and preferences.

7. Strong Financial Stability: Aaa Auto Insurance Tulsa boasts a strong financial stability, ensuring that they can fulfill their obligations and provide the necessary support when you need it most.

Weaknesses

1. Limited Availability: Aaa Auto Insurance Tulsa operates primarily in the Tulsa area, which means they may not be accessible to people residing outside this region.

2. Lack of Online Quote Option: While Aaa Auto Insurance Tulsa provides various communication channels for obtaining quotes, they do not offer an online quote option that some customers may prefer for quick comparison.

3. Limited Online Account Services: Aaa Auto Insurance Tulsa’s online portal lacks some features commonly found in other insurance providers’ websites, limiting the self-service options available to policyholders.

4. Higher Premiums for High-Risk Drivers: As with any insurance company, Aaa Auto Insurance Tulsa may charge higher premiums for drivers with poor driving records or who are classified as high-risk.

5. Limited Coverage for Unique Vehicles: Aaa Auto Insurance Tulsa may have limited coverage options for specialty or modified vehicles.

6. Limited Mobile App Features: While Aaa Auto Insurance Tulsa has a mobile app for policy management, it lacks certain features found in other insurance apps, such as virtual ID cards and accident reporting.

7. Possible Wait Times: During busy periods, contacting Aaa Auto Insurance Tulsa’s customer service may result in longer-than-desired wait times.

Aaa Auto Insurance Tulsa: Coverage Options and Benefits

| Coverage Type | Description |

|---|---|

| Liability Insurance | Protects you against legal and financial liabilities if you cause an accident resulting in property damage or bodily injury to others. |

| Collision Coverage | Covers the costs of repair or replacement of your vehicle if it is damaged due to a collision with another vehicle or object. |

| Comprehensive Coverage | Provides protection against damage to your vehicle from non-collision incidents such as theft, vandalism, natural disasters, and more. |

| Uninsured/Underinsured Motorist Coverage | Protects you from expenses related to accidents involving drivers who don’t have insurance or have insufficient coverage. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers in case of injuries sustained in an accident, regardless of fault. |

| Rental Car Reimbursement | Provides coverage for rental car expenses while your insured vehicle is undergoing repairs after a covered claim. |

| Roadside Assistance | Offers emergency services such as towing, fuel delivery, battery jump-start, and tire changes to get you back on the road quickly. |

Frequently Asked Questions about Aaa Auto Insurance Tulsa

1. Can I get a quote online?

Yes, you can obtain a quote by calling Aaa Auto Insurance Tulsa’s customer service or visiting one of their local branches.

2. How can I file a claim?

To file a claim, you can contact Aaa Auto Insurance Tulsa’s claims department via phone or online through their website.

3. Is roadside assistance included in all policies?

Roadside assistance is an optional coverage that you can add to your policy for an additional fee.

4. Are there discounts available for safe drivers?

Aaa Auto Insurance Tulsa offers various discounts, including those for safe drivers. Contact their customer service to learn more about the discounts you may be eligible for.

5. Does Aaa Auto Insurance Tulsa offer coverage for classic cars?

Yes, Aaa Auto Insurance Tulsa provides coverage options specifically designed for classic cars. Contact their customer service for more information.

6. Can I manage my policy online?

While Aaa Auto Insurance Tulsa offers an online portal for basic policy management, some features may be limited. It is best to contact their customer service for specific inquiries.

7. How can I contact Aaa Auto Insurance Tulsa?

You can reach Aaa Auto Insurance Tulsa’s customer service by phone at XXX-XXX-XXXX or visit their website for more contact options.

Conclusion

In conclusion, Aaa Auto Insurance Tulsa offers affordable and reliable car insurance options in the Tulsa area. With competitive rates, extensive coverage options, and excellent customer service, Aaa Auto Insurance Tulsa is a great choice for those looking to protect their vehicles. While there are a few limitations in terms of availability and online services, the strengths of Aaa Auto Insurance Tulsa outweigh its weaknesses. Take action today and secure your vehicle’s safety by considering Aaa Auto Insurance Tulsa for your car insurance needs.

Closing Words and Disclaimer

Thank you for taking the time to read about Aaa Auto Insurance Tulsa. Remember, when choosing an insurance provider, always read and understand the terms and conditions of the policy before making a decision. Insurance coverage may vary based on individual circumstances and policy options. The information provided in this article is for informational purposes only and should not be considered as professional advice. For specific and personalized guidance, please consult with a qualified insurance agent or representative.