Get Usaa Auto Insurance Quote

Contents

- 1 Welcome, Readers!

- 2 Introduction

- 3 Strengths of Get USAA Auto Insurance Quote

- 4 Weaknesses of Get USAA Auto Insurance Quote

- 5 Table: Get USAA Auto Insurance Quote Information

- 6 Frequently Asked Questions

- 6.1 1. How do I obtain a USAA auto insurance quote?

- 6.2 2. Can I get USAA auto insurance if I’m not a military member or veteran?

- 6.3 3. Are there any discounts available for USAA auto insurance?

- 6.4 4. Does USAA offer roadside assistance coverage?

- 6.5 5. Can I file a claim online with USAA?

- 6.6 6. How can I make payments for my USAA auto insurance policy?

- 6.7 7. Can I customize my USAA auto insurance policy?

- 7 Conclusion

Welcome, Readers!

Greetings to all the readers who are seeking comprehensive and reliable auto insurance coverage. In this article, we will delve into the world of USAA auto insurance and guide you through the process of obtaining a quote that meets your specific requirements. Whether you are a military service member, a veteran, or a family member of one, USAA understands the unique needs and challenges you may face, making them an ideal choice for auto insurance.

Introduction

Established in 1922, USAA has been serving military members and their families for nearly a century. Their commitment to providing exceptional products and services has earned them a trusted reputation in the insurance industry. USAA auto insurance offers an array of benefits that cater to the specific needs of military personnel, including competitive rates, comprehensive coverage options, and outstanding customer service.

As you navigate through the auto insurance market, it’s crucial to consider all aspects of the policies available to you. By obtaining a USAA auto insurance quote, you gain access to a plethora of coverage options tailored to your preferences and peace of mind.

Now, let’s dive deeper into the strengths and weaknesses of obtaining a USAA auto insurance quote.

Strengths of Get USAA Auto Insurance Quote

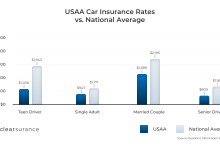

1. Competitive Rates

When acquiring an auto insurance quote from USAA, you can expect competitive rates that are tailored to fit your budget. USAA’s commitment to providing affordable coverage ensures that you receive exceptional value for your money.

2. Comprehensive Coverage Options

USAA offers a wide range of coverage options to suit your specific needs. Whether you’re looking for liability coverage, collision coverage, or comprehensive coverage, USAA allows you to customize your policy to protect yourself and your vehicle adequately.

3. Excellent Customer Service

One of USAA’s standout features is their commitment to providing exceptional customer service. Their knowledgeable representatives are always ready to assist you in navigating the insurance process, answering any inquiries you may have, and ensuring you’re fully satisfied with your coverage.

4. Military Expertise

Being a company dedicated to serving military members and their families, USAA understands the unique circumstances and demands of military life. Their policies are tailored to address the challenges that military personnel often face, such as deployments and relocations.

5. Positive Reputation

USAA has earned a stellar reputation in the industry, showcased by their high customer satisfaction ratings and positive reviews. Their commitment to serving the military community sets them apart from other insurance providers, further solidifying their positive reputation.

6. Convenient Mobile App

USAA offers a user-friendly mobile app that allows you to access your policy information, make payments, file claims, and even request roadside assistance. This convenience ensures that you have access to your insurance coverage wherever you go.

7. Flexibility and Additional Benefits

USAA understands that life changes, and your insurance needs may evolve accordingly. With their flexible policies, you can easily add or remove coverage options as needed. Additionally, USAA provides additional benefits such as accident forgiveness and rental car coverage, providing extra peace of mind.

Weaknesses of Get USAA Auto Insurance Quote

1. Limited Eligibility

As USAA primarily caters to military members, veterans, and their families, eligibility for their auto insurance coverage is limited to those who meet these criteria. This exclusivity may discourage individuals who do not belong to the military community from applying.

2. Geographical Restrictions

USAA auto insurance is not available to everyone nationwide. It is limited to individuals residing in certain states. Before obtaining a quote, it is essential to ensure that USAA operates in your area.

3. No Local Agents

Unlike some other insurance providers, USAA operates solely online and over the phone. They do not have local agents available for in-person assistance. While their customer service is exceptional, some individuals may prefer the convenience of having a local agent.

4. Limited Discounts for Young Drivers

If you have young drivers on your policy, USAA’s available discounts may be limited compared to other insurance providers. This factor is important to consider if you have teenage drivers or young adults on your policy.

5. Lack of Bundling Options

While USAA offers a variety of insurance products, they do not provide bundling options for auto insurance with other types of coverage, such as home insurance or life insurance. This may discourage individuals seeking to consolidate their policies under one provider.

6. Smaller Network of Repair Shops

USAA has a smaller network of approved repair shops compared to some other auto insurance providers. This may limit your options when it comes to selecting a repair facility for your vehicle.

7. Limited Coverage Options for Specialty Vehicles

USAA primarily focuses on providing coverage for standard vehicles, which means their options for specialty vehicles, such as classic cars or motorcycles, may be more limited. If you own a specialty vehicle, it’s essential to consider this potential limitation.

Table: Get USAA Auto Insurance Quote Information

| Policy Coverage | Details |

|---|---|

| Liability Coverage | Protects you financially if you’re responsible for an accident resulting in injury or property damage to others. |

| Collision Coverage | Covers the cost of repairing or replacing your vehicle if it is damaged or totaled in an accident. |

| Comprehensive Coverage | Protects against damage to your vehicle from non-collision incidents such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides coverage if you’re involved in an accident with a driver who has insufficient or no insurance. |

| Rental Car Coverage | Covers the cost of renting a replacement vehicle while your insured vehicle is being repaired. |

| Accident Forgiveness | Protects your rates from increasing due to your first at-fault accident. Available after a specific period of safe driving. |

| Roadside Assistance | Provides services such as towing, flat tire change, lockout assistance, and battery jump-starts. |

Frequently Asked Questions

1. How do I obtain a USAA auto insurance quote?

To obtain a USAA auto insurance quote, you can visit their website or call their dedicated helpline. Provide the required information about yourself, your vehicle, and your insurance preferences to receive a personalized quote.

2. Can I get USAA auto insurance if I’m not a military member or veteran?

No, USAA auto insurance is exclusively available to active military members, veterans, and their families. However, other insurance providers may offer comparable coverage options.

3. Are there any discounts available for USAA auto insurance?

Yes, USAA offers various discounts, such as safe driver discounts, multi-vehicle discounts, and good student discounts. Additionally, members who maintain a good driving record may be eligible for accident forgiveness.

4. Does USAA offer roadside assistance coverage?

Yes, USAA provides roadside assistance coverage as an optional add-on to your auto insurance policy. This coverage can help you in situations such as flat tires, breakdowns, or being locked out of your vehicle.

5. Can I file a claim online with USAA?

Yes, USAA offers an online claims filing process through their website and mobile app. You can easily provide the necessary information and documentation, making the claims process more convenient and efficient.

6. How can I make payments for my USAA auto insurance policy?

You can make payments for your USAA auto insurance policy through various convenient methods, including online payments, automatic payments, phone payments, and mail-in payments.

7. Can I customize my USAA auto insurance policy?

Yes, USAA allows you to customize your auto insurance policy to suit your individual needs. You can choose coverage options, adjust deductibles, and add optional features such as rental car coverage or roadside assistance.

Conclusion

In conclusion, obtaining a USAA auto insurance quote presents numerous advantages for military members, veterans, and their families. With competitive rates, comprehensive coverage options, and exceptional customer service, USAA ensures that you receive the protection you need for your vehicle. While certain limitations exist, such as eligibility requirements and geographical restrictions, USAA’s strengths far outweigh these weaknesses. To secure reliable and tailored auto insurance coverage, we highly recommend obtaining a USAA auto insurance quote and experiencing their exemplary service firsthand.

Do not miss this opportunity to protect your vehicle and enjoy the benefits of USAA’s specialized coverage. Why wait? Get your personalized quote today and embark on a worry-free journey on the road!

Disclaimer: The information provided in this article is intended for informational purposes only. Policy details, coverage options, and availability may vary depending on your location and eligibility. Please consult the official USAA website or contact their representatives for the most accurate and up-to-date information.