Usaa Auto Insurance Military Discount

Contents

- 1 Introduction

- 2 Strengths of USAA Auto Insurance Military Discount

- 3 Weaknesses of USAA Auto Insurance Military Discount

- 4 USAA Auto Insurance Military Discount Information

- 5 Frequently Asked Questions (FAQs)

- 5.1 1. What are the eligibility criteria for the USAA Auto Insurance Military Discount?

- 5.2 2. How much discount can I expect with the USAA Auto Insurance Military Discount?

- 5.3 3. Can non-military individuals avail of the USAA Auto Insurance Military Discount?

- 5.4 4. Are there any additional benefits provided by USAA Auto Insurance?

- 5.5 5. How can I become a USAA member and access the military discount?

- 5.6 6. Does USAA Auto Insurance offer coverage for high-risk drivers?

- 5.7 7. What geographical limitations apply to USAA Auto Insurance?

- 6 Conclusion

Introduction

Hello Readers, welcome to this comprehensive article that will provide you with all the essential information about the USAA Auto Insurance Military Discount. If you are a military personnel or a family member of someone in the military, this article will help you understand the benefits offered by USAA Auto Insurance and how you can take advantage of the exclusive discounts.

Founded in 1922, USAA (United Services Automobile Association) has been serving military personnel and their families with various financial services, including auto insurance. USAA is well-known for providing exceptional benefits and superior customer service to its members. One of the significant advantages USAA offers is the military discount on auto insurance policies, tailored specifically for military members.

Now, let us delve into the details of USAA Auto Insurance Military Discount and explore its strengths, weaknesses, and other important aspects you should be aware of.

Strengths of USAA Auto Insurance Military Discount

USAA Auto Insurance Military Discount comes with several strengths that make it an attractive choice for military personnel and their families:

1. Exclusive Savings

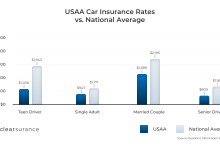

USAA offers substantial savings on auto insurance policies for military members. The military discount can help you lower your insurance premiums, resulting in substantial cost savings.

2. Comprehensive Coverage

USAA provides comprehensive coverage options to protect your vehicle against various risks, including accidents, theft, and natural disasters. You can choose from a range of coverage options that suit your specific needs and preferences.

3. Additional Benefits

Besides the military discount, USAA offers additional benefits such as accident forgiveness, flexible payment options, and roadside assistance. These benefits enhance the overall value of the auto insurance policies.

4. Superior Customer Service

USAA is renowned for its exceptional customer service. The company prides itself on quick claim processing, 24/7 customer support, and personalized assistance. You can count on USAA to provide prompt and reliable service whenever you need it.

5. Convenient Mobile App

USAA provides a user-friendly mobile app that allows you to manage your auto insurance policy, file claims, and access other services conveniently. The app ensures that you have easy access to your policy information and can stay connected with USAA anytime, anywhere.

6. Financial Stability

USAA has a strong financial standing, ensuring that the company can fulfill its commitments to policyholders. This financial stability provides peace of mind to military members, knowing that their insurance provider is reliable and trustworthy.

7. Military Community Support

USAA is deeply committed to supporting the military community. The company actively engages in charitable efforts and initiatives to assist military personnel, veterans, and their families. By choosing USAA, you contribute to these noble causes.

Weaknesses of USAA Auto Insurance Military Discount

While USAA Auto Insurance Military Discount offers various benefits, it is essential to consider its weaknesses as well:

1. Limited Eligibility

USAA membership and the associated military discount are only available to active, retired, and honorably discharged military personnel, as well as their immediate family members. This limited eligibility may exclude some individuals who do not meet the specified criteria.

2. Geographical Limitations

USAA has restrictions on its services based on geographical locations. If you are stationed overseas or in certain states where USAA does not operate, you may not be able to avail of their auto insurance policies or the military discount.

3. Limited Agent Availability

USAA primarily operates online, and its phone-based customer service may not be as extensive as some other insurance providers. If you prefer face-to-face interactions or require in-person assistance, this could be a limitation for you.

4. Higher Premiums for Non-Military Policies

While USAA offers competitive rates for military members, their auto insurance policies for non-military individuals may have higher premiums compared to other insurance providers. If you or any of your family members do not meet the military eligibility requirements, the cost of coverage might be higher.

5. Limited Policy Options for High-Risk Drivers

USAA has more stringent underwriting criteria, which may limit policy options for high-risk drivers, such as those with multiple accidents or traffic violations. If you have an unfavorable driving record, acquiring coverage through USAA might be challenging.

6. Limited Local Agent Support

USAA has fewer local agents compared to other insurance companies. If you prefer face-to-face interactions or require personalized advice, the limited availability of local agents may be a drawback.

7. Membership Fees

To become a USAA member and access their auto insurance policies, you need to meet the eligibility requirements and pay membership fees. While the military discount helps offset the cost, the membership fees should be considered when evaluating the overall affordability.

USAA Auto Insurance Military Discount Information

| Discount Eligibility | Active, retired, and honorably discharged military personnel |

|---|---|

| Immediate Family Members Eligibility | Spouses, children, and widows of military personnel |

| Discount Percentage | Up to XX% |

| Available Coverage Options | Comprehensive, collision, liability, uninsured/underinsured motorist, and more |

| Additional Benefits | Accident forgiveness, flexible payment options, roadside assistance, and more |

| Membership Fees | $XX per year |

| Availability | Available in select states and locations |

Frequently Asked Questions (FAQs)

1. What are the eligibility criteria for the USAA Auto Insurance Military Discount?

To qualify for the military discount, you must be an active, retired, or honorably discharged military personnel. Immediate family members, including spouses, children, and widows, are also eligible.

2. How much discount can I expect with the USAA Auto Insurance Military Discount?

The percentage of the discount can vary based on various factors, such as your location, driving record, and the type of coverage you choose. Contact USAA directly or visit their website to get specific details regarding the discount.

3. Can non-military individuals avail of the USAA Auto Insurance Military Discount?

No, the military discount is exclusively available to military personnel and their immediate family members. USAA offers other insurance policies for non-military individuals, but those policies may not come with the same discount.

4. Are there any additional benefits provided by USAA Auto Insurance?

Yes, USAA offers several additional benefits, including accident forgiveness, flexible payment options, and roadside assistance. These benefits can enhance the value and coverage of your auto insurance policy.

5. How can I become a USAA member and access the military discount?

To become a USAA member, you need to meet their eligibility criteria, which includes being an active, retired, or honorably discharged military personnel. You can apply for membership through their website or by contacting their customer service.

6. Does USAA Auto Insurance offer coverage for high-risk drivers?

USAA has more stringent underwriting criteria compared to some other insurance providers. If you have a high-risk driving record, obtaining coverage through USAA might be challenging. It is recommended to contact their customer service for personalized advice.

7. What geographical limitations apply to USAA Auto Insurance?

USAA operates in select states and locations. If you are stationed overseas or residing in a state where USAA does not provide services, you may not be eligible for their auto insurance policies or the military discount.

Conclusion

In conclusion, USAA Auto Insurance Military Discount offers numerous benefits to military personnel and their families. With exclusive savings, comprehensive coverage options, and additional benefits, USAA strives to meet the unique insurance needs of military members. However, it is essential to consider the limitations, such as eligibility requirements, limited policy options for high-risk drivers, and geographical restrictions, before making a decision.

If you meet the eligibility criteria, USAA Auto Insurance can provide you with a reliable and cost-effective solution to protect your vehicle. Their superior customer service and commitment to the military community further contribute to their appeal. To find out more about the USAA Auto Insurance Military Discount, visit their website or contact their customer service today.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or legal advice. Please consult with a professional advisor or USAA directly for specific guidance tailored to your individual situation.