Aaa South Jersey Auto Insurance

Contents

- 1 The Best Auto Insurance Option in South Jersey

- 2 Introduction

- 3 Strengths of Aaa South Jersey Auto Insurance

- 4 Table: Complete Information about Aaa South Jersey Auto Insurance

- 5 Frequently Asked Questions (FAQs)

- 5.1 1. What is the minimum liability coverage required in South Jersey?

- 5.2 2. Does Aaa South Jersey Auto Insurance offer discounts for safe drivers?

- 5.3 3. Can I file a claim online with Aaa South Jersey Auto Insurance?

- 5.4 4. Are there any additional benefits included in the Aaa South Jersey Auto Insurance policies?

- 5.5 5. How can I contact Aaa South Jersey Auto Insurance customer service?

- 5.6 6. Are there any options to bundle my auto insurance with other policies?

- 5.7 7. Can I customize my coverage options with Aaa South Jersey Auto Insurance?

- 6 Conclusion

The Best Auto Insurance Option in South Jersey

Hello Readers,

Welcome to our comprehensive guide on Aaa South Jersey Auto Insurance. In this article, we will explore the features, strengths, and weaknesses of this renowned insurance provider. Whether you are a current policyholder or considering switching to Aaa South Jersey Auto Insurance, this article will give you a deeper understanding of the company and help you make an informed decision. So, let’s dive in.

Introduction

Aaa South Jersey Auto Insurance is a trusted and reliable insurance company serving residents of South Jersey for decades. With its commitment to customer satisfaction and competitive rates, it has become a go-to choice for individuals and families seeking affordable and comprehensive auto insurance coverage.

Founded in the early 20th century, Aaa South Jersey Auto Insurance has grown to become one of the largest insurance providers in the region. The company’s extensive network of agents and dedicated customer service ensure that policyholders receive personalized attention and prompt assistance whenever needed.

Now, let’s explore the strengths and weaknesses of Aaa South Jersey Auto Insurance in detail, so you can make an informed decision about your auto insurance needs.

Strengths of Aaa South Jersey Auto Insurance

1. Extensive Coverage Options: Aaa South Jersey Auto Insurance offers a wide range of coverage options tailored to meet the unique needs of South Jersey residents. From basic liability coverage to comprehensive plans, there is a policy for every driver.

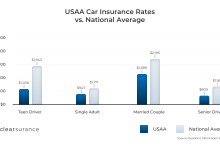

2. Competitive Rates: Aaa South Jersey Auto Insurance strives to provide affordable rates without compromising on coverage quality. The company offers competitive premiums that fit within most budgets.

3. Excellent Customer Service: One of the standout features of Aaa South Jersey Auto Insurance is its commitment to excellent customer service. With a 24/7 helpline and a network of local agents, policyholders can always count on prompt assistance.

4. Convenient Claims Process: Aaa South Jersey Auto Insurance understands the stress and inconvenience of filing a claim. Their streamlined claims process ensures that policyholders receive timely settlements without unnecessary hassle.

5. Roadside Assistance: Aaa South Jersey Auto Insurance offers reliable roadside assistance services, including towing, battery jump-starts, and lockout assistance. This additional benefit provides peace of mind when unexpected emergencies occur.

6. Discounts and Rewards: Aaa South Jersey Auto Insurance rewards safe drivers with various discounts, reducing insurance costs for responsible individuals. Additionally, they offer incentives for policy bundling and maintaining a good driving record.

7. Financial Stability: Aaa South Jersey Auto Insurance boasts a strong financial foundation, ensuring the ability to honor claims and provide long-term security to policyholders.

Weaknesses of Aaa South Jersey Auto Insurance

1. Limited Availability: Aaa South Jersey Auto Insurance primarily operates in South Jersey. If you reside outside this region, you may need to explore other insurance providers.

2. Few Online Tools: While the company offers a user-friendly website, some policyholders may find a lack of advanced online tools and resources for managing their policies.

3. Conditions for Discounts: While Aaa South Jersey Auto Insurance provides attractive discounts, some policyholders may find it challenging to fulfill the specific criteria required to qualify for certain discounts.

4. Deductible Options: Aaa South Jersey Auto Insurance offers limited deductible options, which may not suit every policyholder’s preferences or financial situation.

5. Limited Mobile App Functionality: Although Aaa South Jersey Auto Insurance provides a mobile app, some users have reported limited functionality and occasional technical glitches.

6. Appointments for In-person Services: In certain cases, policyholders may need to schedule appointments for in-person services, which can be inconvenient for those with time constraints.

7. Limited Bundling Options: While Aaa South Jersey Auto Insurance offers bundling discounts, the options for bundling with other insurance products may be limited.

Table: Complete Information about Aaa South Jersey Auto Insurance

| Types of Coverage | Minimum Coverage | Additional Benefits |

|---|---|---|

| Liability Coverage | $15,000/$30,000 for Bodily Injury $5,000 for Property Damage |

– |

| Collision Coverage | – | Repair or Replacement Costs |

| Comprehensive Coverage | – | Theft, Vandalism, Natural Disasters |

| Personal Injury Protection (PIP) | $15,000 per person $250,000 for severe injuries |

Medical Expenses, Lost Wages |

Frequently Asked Questions (FAQs)

1. What is the minimum liability coverage required in South Jersey?

The minimum liability coverage required in South Jersey is $15,000/$30,000 for bodily injury and $5,000 for property damage.

2. Does Aaa South Jersey Auto Insurance offer discounts for safe drivers?

Yes, Aaa South Jersey Auto Insurance rewards safe drivers with various discounts, helping to lower insurance costs.

3. Can I file a claim online with Aaa South Jersey Auto Insurance?

Yes, Aaa South Jersey Auto Insurance offers online claim filing options for added convenience.

4. Are there any additional benefits included in the Aaa South Jersey Auto Insurance policies?

Aaa South Jersey Auto Insurance offers additional benefits such as roadside assistance, rental car coverage, and emergency travel expense reimbursement.

5. How can I contact Aaa South Jersey Auto Insurance customer service?

You can reach Aaa South Jersey Auto Insurance customer service by calling their 24/7 helpline or contacting a local agent.

6. Are there any options to bundle my auto insurance with other policies?

Yes, Aaa South Jersey Auto Insurance offers bundling options with homeowners, renters, and other insurance policies for added convenience and savings.

7. Can I customize my coverage options with Aaa South Jersey Auto Insurance?

Yes, Aaa South Jersey Auto Insurance provides flexibility in choosing coverage options based on your individual needs and preferences.

Conclusion

In conclusion, Aaa South Jersey Auto Insurance is a leading choice for auto insurance in South Jersey. With extensive coverage options, competitive rates, and stellar customer service, it provides an excellent overall experience for policyholders.

While there are some limitations, such as limited availability and fewer online tools, the strengths outweigh the weaknesses for most drivers. Aaa South Jersey Auto Insurance’s commitment to customer satisfaction and financial stability make it a reliable and trustworthy insurance provider.

If you are seeking affordable and comprehensive auto insurance coverage in South Jersey, we highly recommend considering Aaa South Jersey Auto Insurance. Take the first step to protect yourself and your vehicle by contacting Aaa South Jersey Auto Insurance today.

Disclaimer: The information provided in this article is for informational purposes only. Please refer to the official website of Aaa South Jersey Auto Insurance for the most accurate and up-to-date details.

Thank you for reading!